The 2009 Federal Adoption Tax Credit will be $12,150.

This is for all qualified adoption expenses in the year the family finalizes their adoption. We recommend families consult a tax professional regarding their tax needs.

PLEASE NOTE: Current tax filing for the 2009 tax season provides for $12,150 adoption tax credit. We strongly recommend adoptive families consult a legal or tax professional for more details.

What is the Hope For Children Act? The Hope for Children Act (Public Law 107-16) provides tax credit for “qualifying adoption expenses” to $12,150.(2009) It also increases the employer adoption assistance exclusion to $10,000.

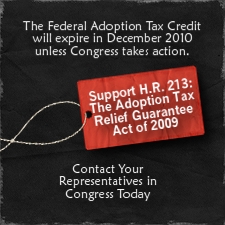

When did the Federal adoption tax credit go into effect? The Hope for Children Act is effective January 1, 2002. This expanded tax credit will sunset and the Adoption Credit will revert to its original $5,000 cap in December 2010, unless the sunset is repealed. A current bill The Adoption Tax Relief Guarantee Act of 2009, H.R. 213 will extend or make permanent the expanded adoption tax credit. Contact your state senators and representatives to urge their support of this important legislation. To learn more about the Adoption Tax Credit's history, click here.

What are ‘qualified adoption expenses? According to the IRS: “Reasonable and necessary adoption fees, court costs, attorney fees, traveling expenses (including meals & lodging) and other expenses related to, and whose principal purpose is for, the legal adoption of an eligible child.”

Who qualifies for the tax credit? In 2009 persons with modified adjusted gross incomes of $182,180 or less, phasing out for modified adjusted gross incomes up to $222,180.

Do all adoptions qualify for the tax credit? Non-special needs domestic adoptions and FINALIZED international adoptions qualify. Overseas adoptions must be finalized in order to be legal and deemed a US citizen.

What about special needs adoptions? Domestic special needs adoptions are defined as children who are US citizens and determined by the state of residence to qualify for financial subsidy for adoption. We have a special post coming soon by a family who has just adopted a special needs infant domestically, so stay tuned!!!

How does the tax credit work for international adoptions? International adoptions must be finalized. While some adoptions are finalized in the child’s country of birth, state law in the United States governing finalization varies. All states do not recognize “adoption finalization” overseas, requiring families in those states to re-finalize the adoption to qualify for the tax credit.

Can families claim the full credit over multiple years? Yes, the credit can be applied against tax liability over six years or whenever expenses reach the $12,150 cap (2009), whichever comes first.

Wednesday, April 14, 2010

Subscribe to:

Post Comments (Atom)

2 comments:

Those who adopt through DHS also qualify for the credit because all DHS adoptions are considered special needs.

Thank you Molly for this information..

Post a Comment